The following was written by Dean Foreman, Ph.D., Chief Economist at the Texas Oil & Gas Association (TXOGA):

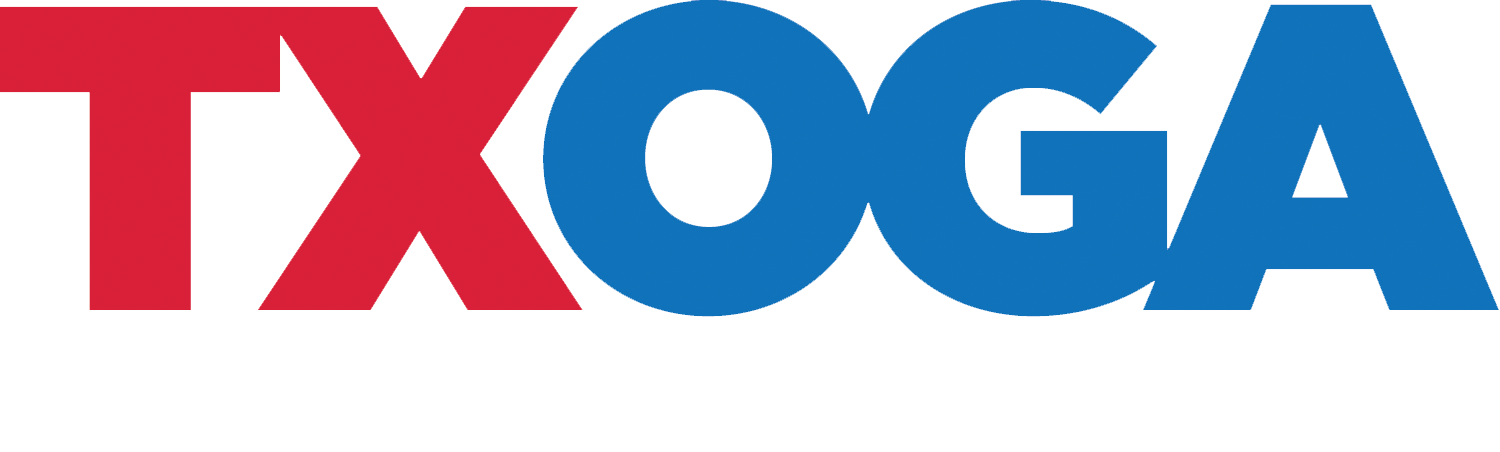

Three quarters into 2024, TXOGA’s continuous monitoring of global, U.S., and Texas economies shows resilient growth momentum. With recent upgrades projecting above-average growth for 2025, we observe that the economic risks attached to this optimistic outlook appear to be weighted to the downside.

Notably, global demand and production of oil and natural gas have reached record highs. Even under a risk scenario for 2025, these markets are poised for further growth. This article provides the latest insights from our monitoring and analyses, with critical implications for American households, businesses, and—most importantly—Texas, the bedrock of energy security and affordability.

Unexpected Upgrades

Starting points significantly shape expectations. In February, we highlighted that GDP growth forecasts were being upgraded and indicators from TXOGA’s Weekly Chartbook suggested the potential for exceeding modest official predictions. This view proved correct, as the International Monetary Fund (IMF) further raised global growth projections in its July 2024 World Economic Outlook (WEO).

However, unlike earlier this year, the economy and financial markets now face a delicate balancing act. The prospect of a “soft landing” hinges on potential interest rate cuts, driven by emerging weaknesses in inflation, labor markets, and GDP growth. This means that while official forecasts project above-average growth in 2025, downside risks have increased.

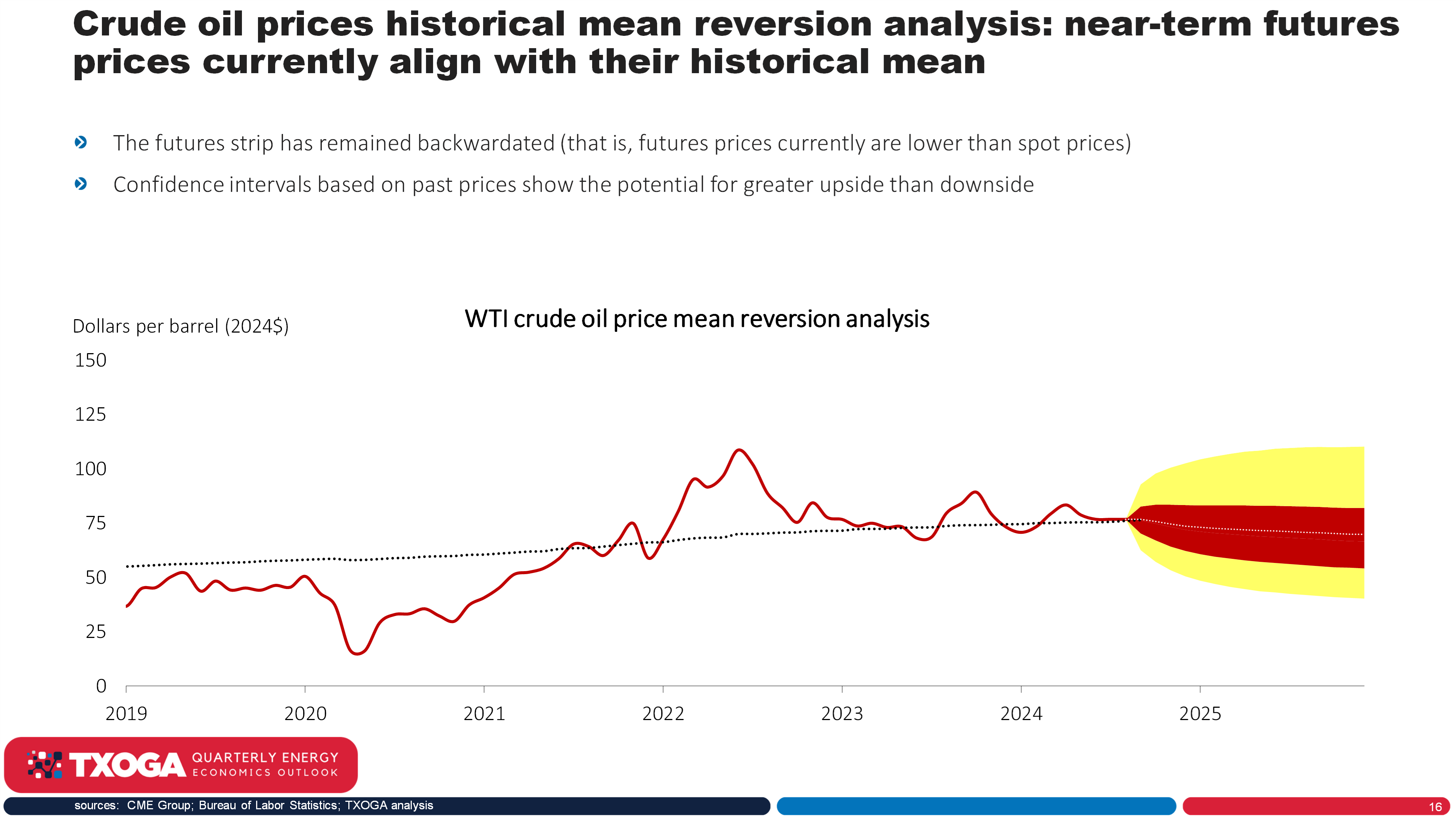

Monetary and fiscal policy changes further complicate the outlook. With above-average global growth, lower U.S. interest rates would reduce the appeal of holding U.S. dollars, potentially weakening the dollar. Historically, a weaker dollar correlates with higher oil prices, especially as economic growth tends to drive oil demand. Together, a weaker dollar and increased demand could push oil prices higher, re-fueling inflation. Accordingly, this financial easing cycle presents multiple factors of significance for commodity markets, particularly oil.

Fiscal policy adds another layer of uncertainty. The IMF’s External Sector Report (July 2024) presents a risk scenario in which delayed reductions in government spending magnify sovereign debt risks, increase global financial stress, and raise economic costs. Both major U.S. Presidential candidates have pledged policies that could exacerbate deficits already deemed unsustainable by the Government Accountability Office (GAO). If financial markets react negatively to unchecked government spending, U.S. consumer spending—which accounts for 70% of the economy—could falter, especially if equity values decline and corporate earnings growth slows in 2025.

Yet, putting aside these risks, global oil demand appears to be on track for another record year.

Record Oil Demand Amid a Well-Supplied Market

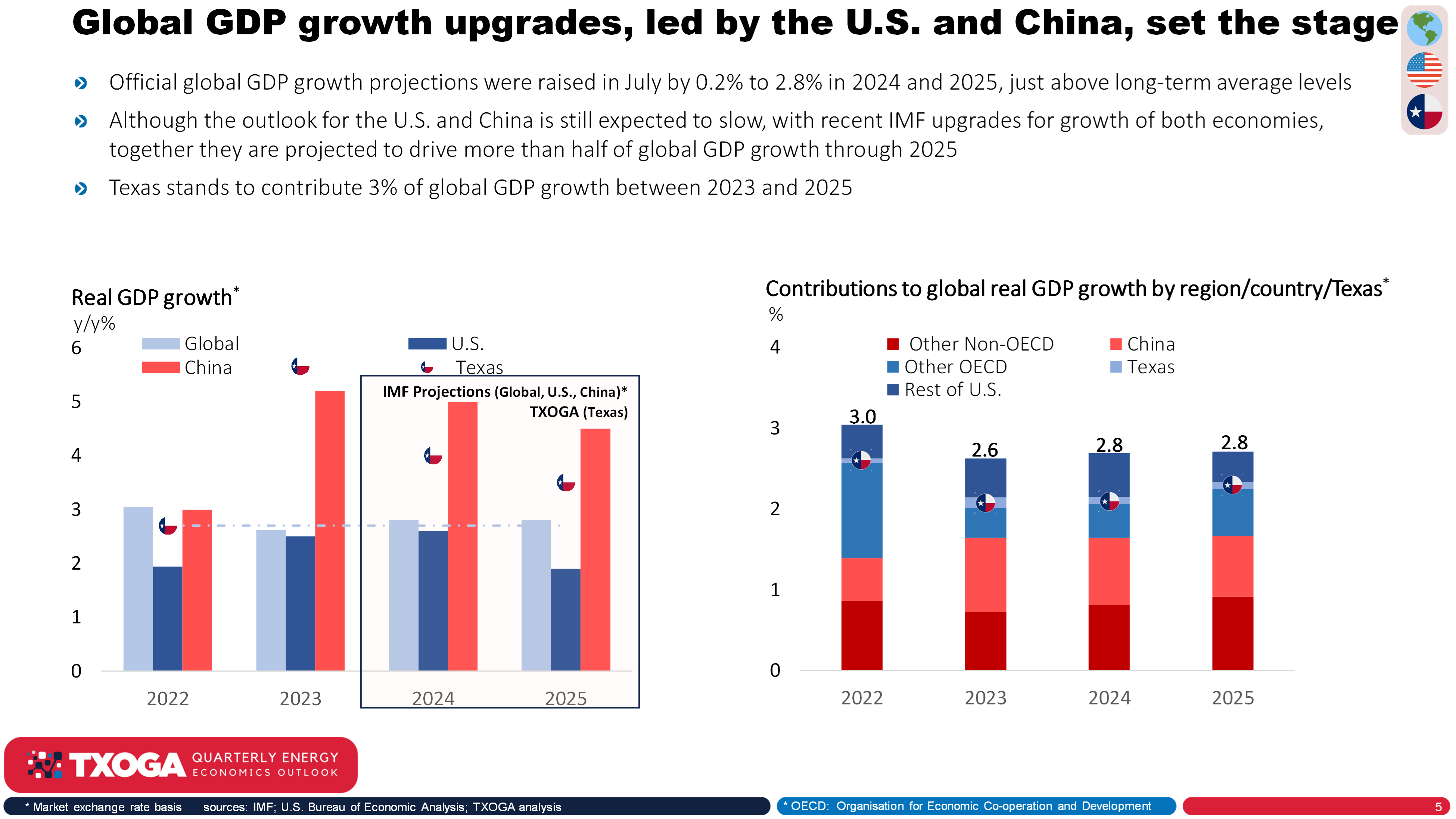

In 2024, global oil demand is on pace to average 103.1 million barrels per day (mb/d), and the Energy Information Administration (EIA) forecasts this to increase to 104.6 mb/d in 2025. Even if GDP growth underperforms—coming in at 2.0% instead of the projected 2.8%—global oil demand is still likely to break records, with a downside risk of about 0.5 mb/d.

Despite this strong demand, global oil markets have remained well supplied. The U.S. continues to lead in supply growth, with EIA projecting an increase of 0.6 mb/d in 2025, equivalent to the combined supply growth of OPEC+ nations. Even with global supply growing by 2.1 mb/d next year, EIA forecasts continued inventory drawdowns through mid-2025, indicating a tightening market. This could heighten OPEC+’s influence in the coming year.

The outlook for natural gas mirrors that of oil, with record global demand and U.S. supply growth continuing. One key difference is the role U.S. natural gas inventories have played in stabilizing European and global markets. Mild winters in 2022 and 2023 prevented severe supply stress, but a return to typical winter weather could lead to increased U.S. natural gas exports and prompt a reevaluation of global supply sufficiency.

Pricing Dynamics and Texas’ Growing Influence

Current oil prices are in line with long-term averages. In contrast, U.S. natural gas prices for August and September 2024 are at their lowest real levels on record. Recent futures contracts for October delivery are priced at around $2.20 per million Btu, well below historical means, but the December contract reflects a 40% rise, signaling expectations of tighter supplies ahead.

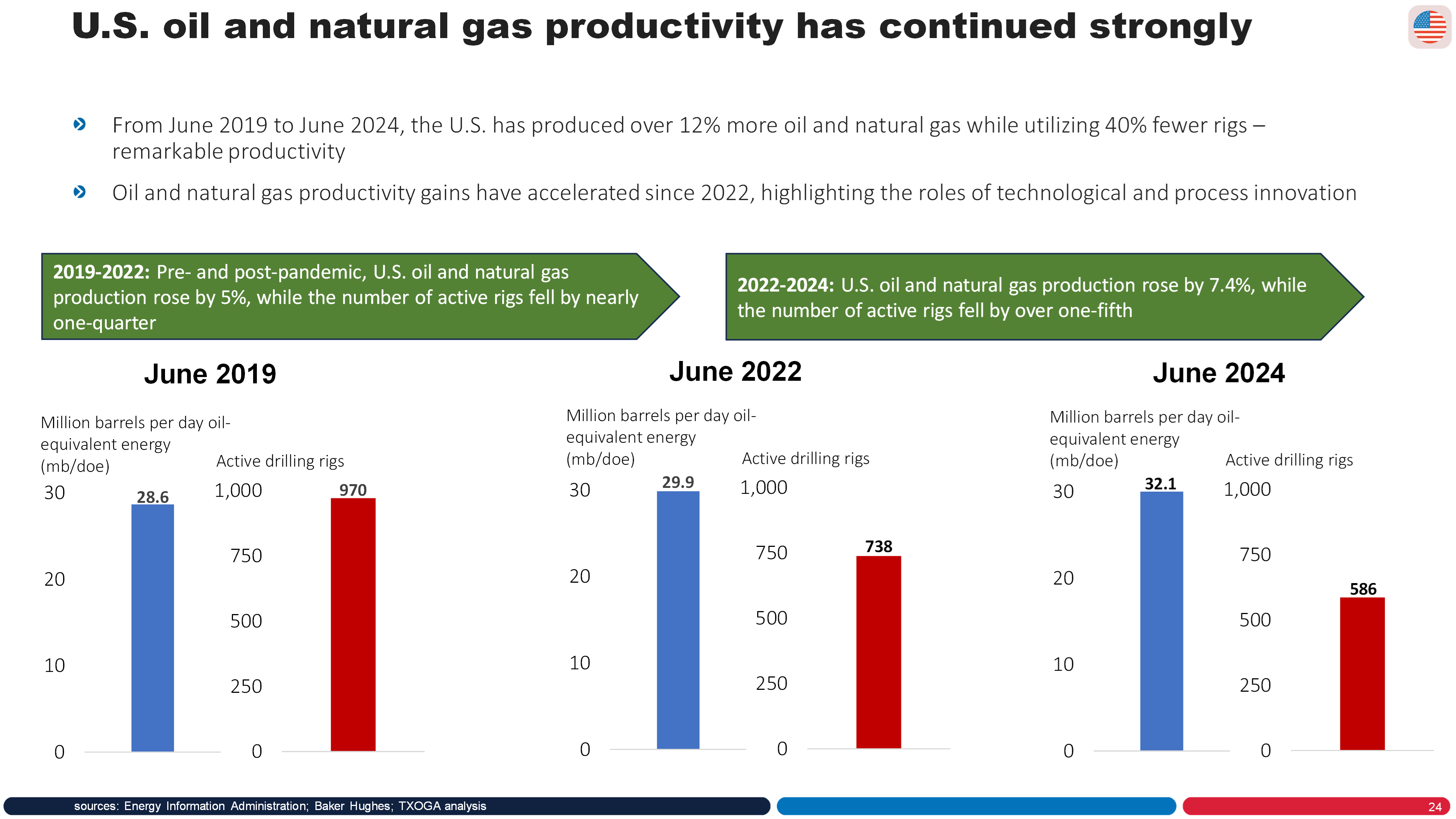

The record-high demand for oil and natural gas, coupled with well-supplied markets, underscores the impressive productivity gains in the U.S. and Texas. Over the past five years, U.S. oil and natural gas production has increased by 12%, and Texas’ output has surged by 20%—all while utilizing 40% fewer rigs. This remarkable productivity growth is led by the Permian Basin and highlights Texas’ expanding share of U.S. oil and natural gas production.

By TXOGA’s estimates, Texas produced 42.8% of U.S. oil and 28.8% of U.S. natural gas year-to-date through August 2024, setting new production records: 5.7 mb/d of crude oil, 3.85 mb/d of natural gas liquids, and 33.2 billion cubic feet per day (bcf/d) of natural gas marketed production (see the latest TXOGA Monthly Energy Economics Review (MEER), for details).

Conclusion

At TXOGA, we remain committed to providing objective, balanced market perspectives. Although downside risks weigh on the official economic outlook, it’s clear that oil and natural gas remain integral to economic activity, consumer goods production, and international trade, despite ongoing challenges. With Texas as the epicenter of U.S. production growth, it’s hard not to feel optimistic about the state’s role in meeting the energy needs of domestic and international consumers.

For further analysis and details, visit the Economic Insights section of TXOGA’s website.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.