The following was written by Dean Foreman, Ph.D., Chief Economist at the Texas Oil & Gas Association (TXOGA):

In the ever evolving economic and energy landscape, the outset of 2024 brings with it updated economic forecasts, particularly in the face of broad expectations for a slowdown. Yet, emerging data show resilience and unexpected growth, challenging preconceived notions and setting the stage for a reevaluation of this year’s prospects.

This article delves into the latest insights from TXOGA’s weekly, monthly, and quarterly monitoring and analyses of economic and energy markets, with critical implications for American households and businesses, core to energy security and affordability, and especially important to Texas.

Official Economic Upgrades 2.0

For the second consecutive year, the first quarter began with a consensus among economists forecasting a slowdown in both the global and U.S. economies. Despite these projections, the weekly TXOGA Chartbook indicators we monitor have consistently shown growth that exceeds these modest expectations, particularly for the U.S. and China.

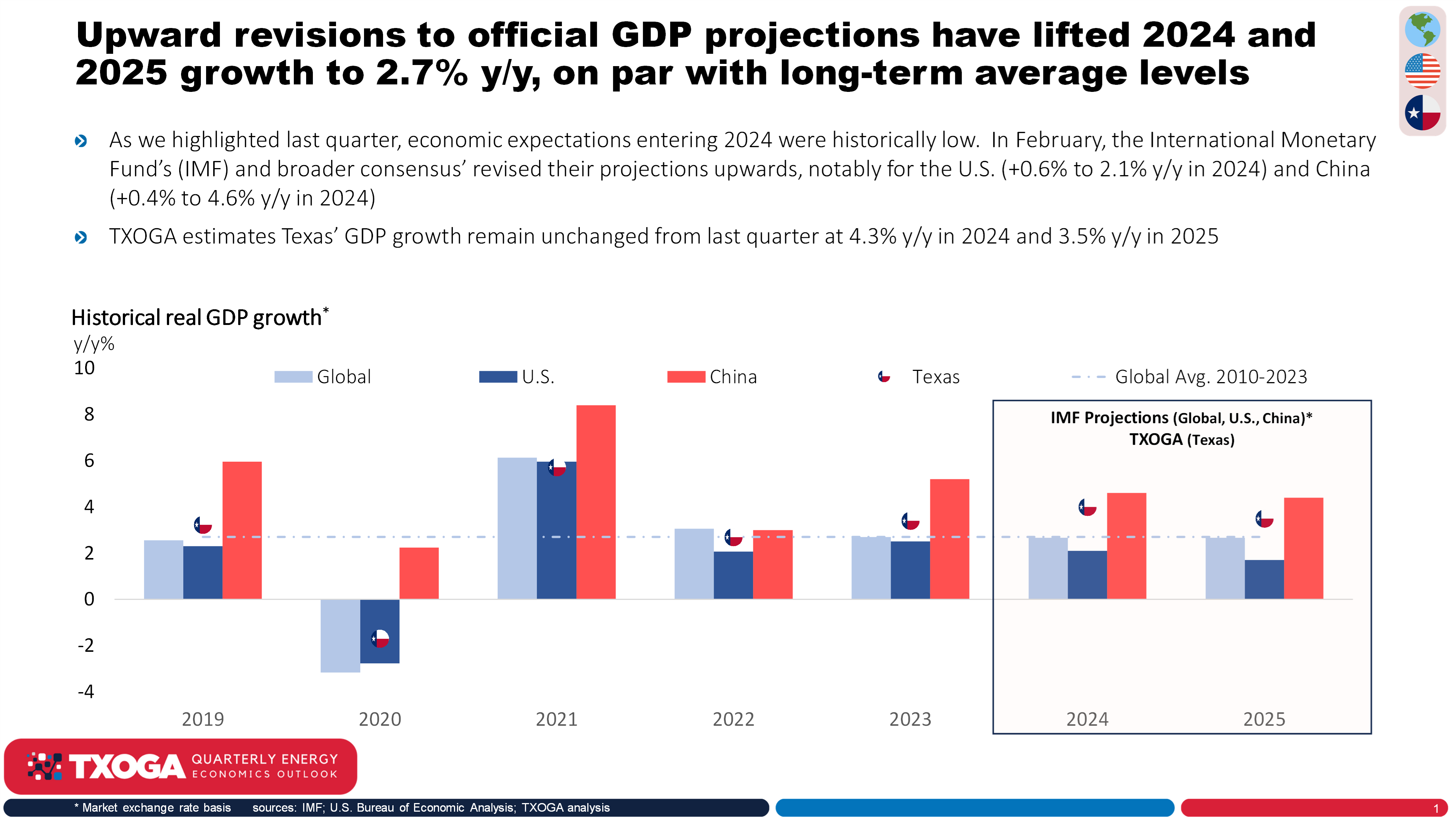

Coming into this year, the International Monetary Fund (IMF) and others projected 2024 real GDP of 1.5% year-over-year (y/y) in the U.S. and 4.2% in China, which was anemic for the U.S. and the slowest non-pandemic growth rate since 1990 for China. Those weak expectations were clearly contrasted by the data for Q4 2023, which showed growth in the U.S. and China at rates of 3.1% y/y and 5.2% y/y, respectively. Consequently, the IMF and the broader economic consensus have significantly upgraded their expectations, and the result adds 0.3% to 2024 global GDP growth on a market exchange rate basis, raising the outlook to 2.7% y/y in 2024 and 2025.

If these estimates prove to be accurate, they represent two years on par with the world’s average growth rate between 2010 and 2023 – with the promise of consecutive record highs for the economy’s size and greater prosperity and opportunities for the typical American household. This is particularly true in Texas where GDP growth has remained the fastest-growing large state economy. TXOGA also estimates that Texas’ economy will continue to outpace that of the U.S. overall, thanks to strong underlying demographic gains coupled with oil and natural gas industry growth on which the U.S. and the world have increasingly relied.

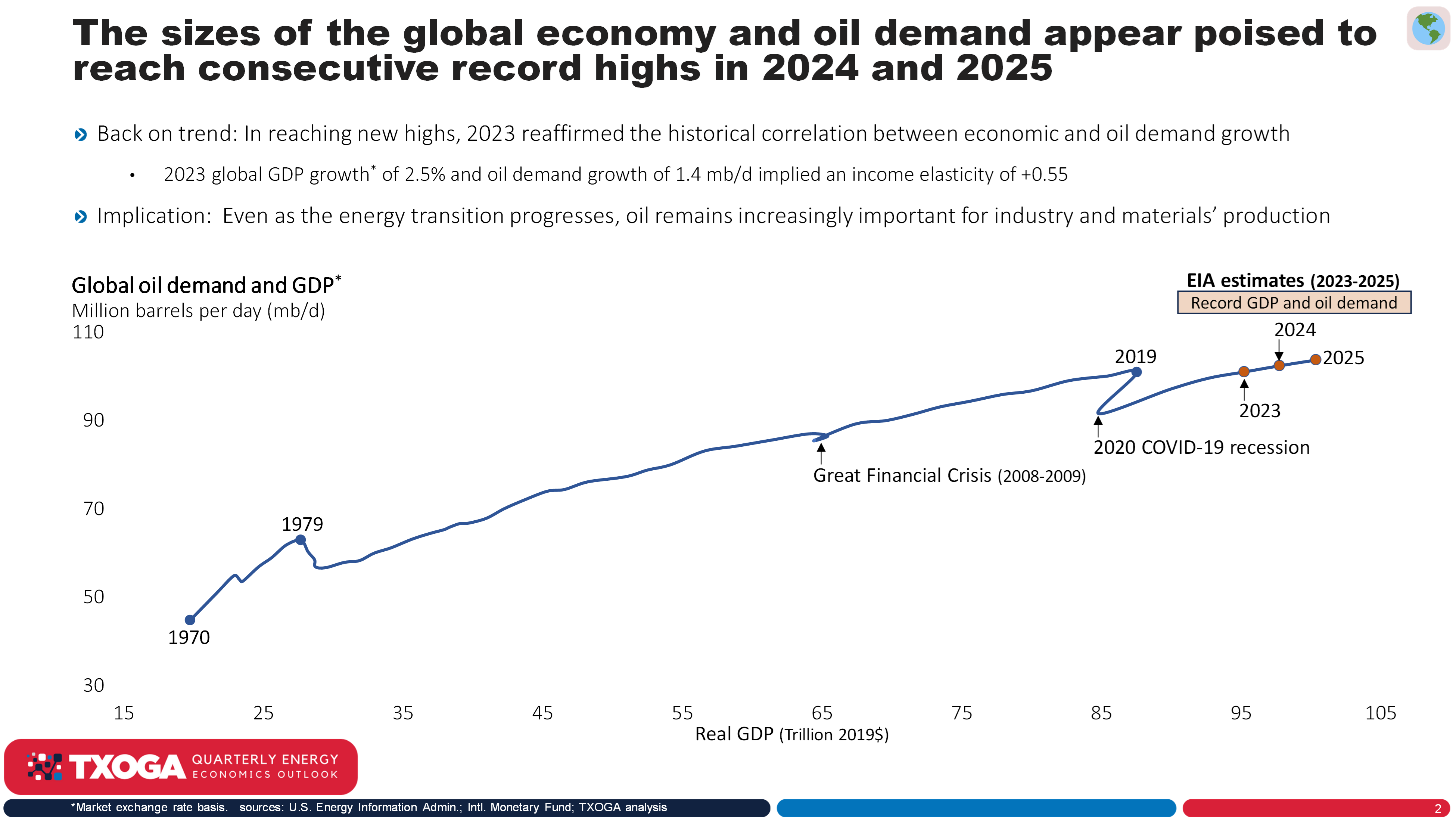

For oil and natural gas, the upgrade also lifts the official U.S. Energy Information Administration (EIA) and International Energy Agency (IEA) projections to records highs for both global oil and natural gas demand this year and again in 2025. This should be unambiguously positive for Texas as a producer, refiner, and exporter across the value chain.

Implications of growth for price inflation and interest rates

Even before the economic upgrades, TXOGA’s stance has been that price inflation is likely to remain persistent. The pandemic highlighted various pressures from workforce, supply chain, trade, and commodity shifts with ongoing structural impacts. Improved economic growth suggests that consumers may not see significant reductions in broad price inflation, which will likely keep interest rates elevated. This scenario presents mixed implications for consumers and businesses, balancing the benefits of a strong job market against desires for lower inflation and interest rates.

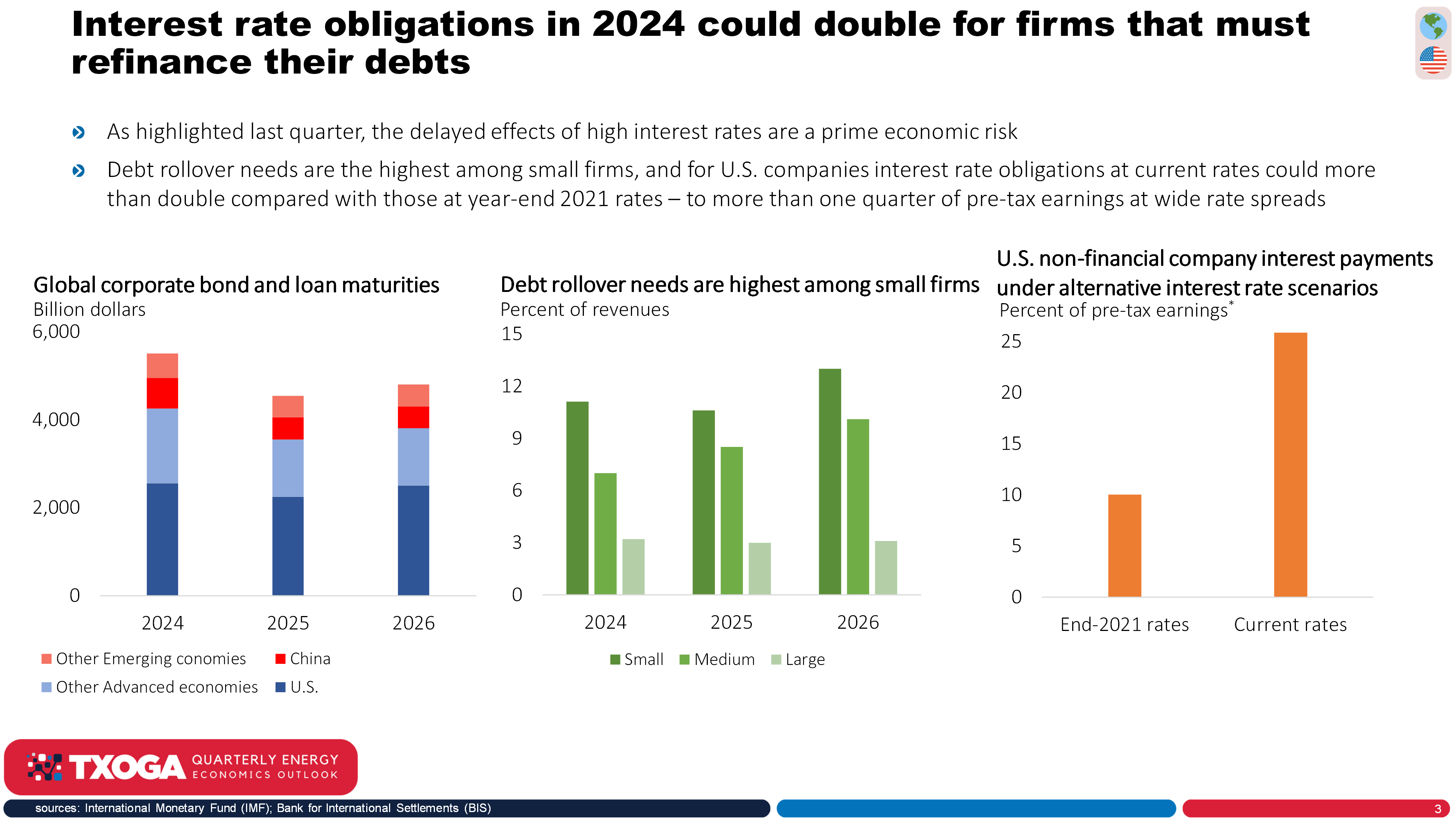

A Key Uncertainty: The Delayed Impacts of Past Interest Rate Hikes

A significant economic uncertainty for both corporations and households is the lagged effects of higher interest rates on borrowing costs and, consequently, consumer spending, which accounts for about 60% of the global economy and roughly 70% in the U.S. As discussed in TXOGA’s Energy and Economics Outlook for Q4 2023, over $5 trillion of global corporate debt is due for refinancing at higher rates in 2024. The Bank for International Settlements (BIS) has found that small and medium-sized enterprises (SMEs) are particularly vulnerable, facing potential interest payment costs that could more than double as a share of their earnings before income taxes. This situation could restrict capital for expansion and exert pressure on employment and operations.

U.S. households are also facing budgetary pressures, with consumer debt reaching a record high of $17.5 trillion, and the Federal Reserve Bank of New York reporting an increase in auto loan delinquencies in Q4 2023. These factors suggest that maintaining current high interest rates could be unsustainable, making some rate cuts likely in 2024 and 2025, even if inflation remains above the Federal Reserve’s target range. The timing of such adjustments, whether proactive or reactive, remains a key question.

The U.S. Presidential Election and Global Geopolitics: Wildcards

Political dynamics underscore the importance of economic data interpretation. A strong economy typically favors incumbents, as evidenced by the rise in U.S. consumer sentiment in January 2024 to its highest level since July 2021, according to the University of Michigan’s consumer sentiment index. However, mixed feelings about elevated price inflation versus solid employment and the magnification of disparities by U.S. Presidential election politics, especially across different states and income brackets, complicate the outlook.

For the oil and natural gas industry, recent geopolitical instabilities underscore the risks of investing in unstable regions and the importance of reliable energy trade. Consider events such as Russia’s war in Ukraine and the Nordstream pipeline issues, Israel-Hamas and shutting of the Leviathan natural gas field, Mozambique raids impeding liquefied natural gas (LNG) development, and Houthi Red Sea oil tanker attacks. Ordinarily these events would showcase the relative stability of supplies from the U.S. Gulf Coast, but the Biden Administration’s arbitrary pause of new LNG export approvals has, in the eyes of global consumers, placed the U.S. in a similar untrustworthy vein as Russia. The Biden Administration’s stated rationale for the pause was to prevent domestic energy price increases, despite compelling evidence from a recent TXOGA analysis showing that U.S. LNG exports have consistently motivated domestic production growth, which in turn has ultimately kept downward pressure on prices.

The outcome of the 2024 U.S. Presidential and Congressional elections could have significant implications for global energy markets and U.S. energy security, investment, and trade.

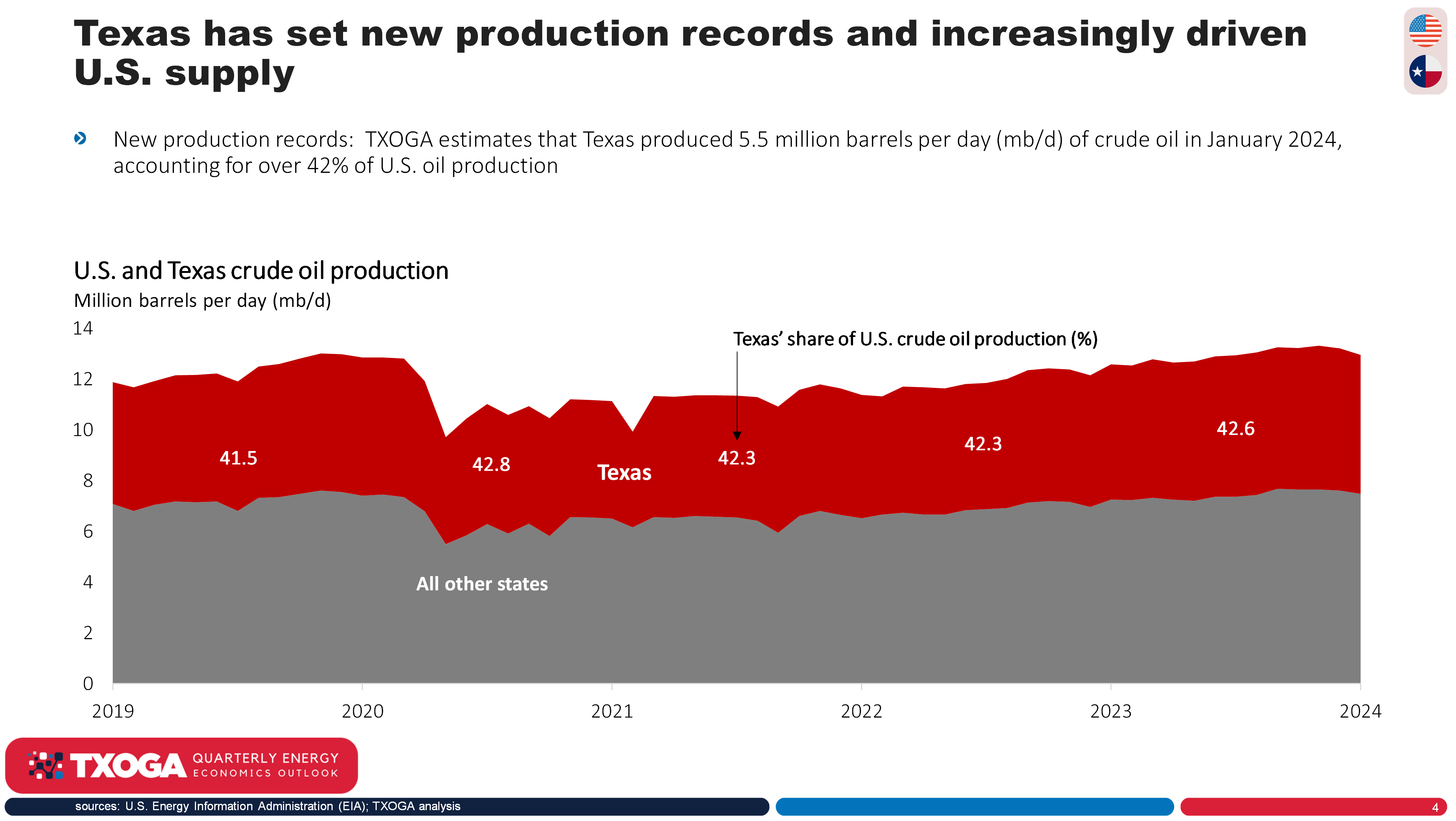

Texas’ Increased Criticality

Looking ahead to 2024, 2025, and beyond, Texas’ role in oil and natural gas drilling, production, processing, storage, transportation, and exports has become increasingly critical. In 2023, Texas accounted for nearly 43% of U.S. oil production and 28% of U.S. natural gas production, despite relatively modest drilling activity. This achievement is attributed to significant productivity increases across major Texas basins, including the Anadarko (+32.0% y/y), Eagle Ford (+27.2% y/y), Haynesville (+18.3% y/y), and Permian (+20.0% y/y) per the EIA.

TXOGA’s Monthly Energy Economics Reviews (MEER) highlight Texas’ record-breaking achievements in 2023, including new highs in crude oil and natural gas liquids (NGL) production, and natural gas marketed production. These milestones have propelled economic gains, as outlined in TXOGA’s 2023 Annual Energy & Economic Impact Report, with the oil and natural gas industry directly employing more than 480,000 Texans in fiscal year23, generating nearly $60 billion in annual pay, and contributing significantly to Texas’ GDP. The industry’s tax contributions have also reached historic levels – $26.3 billion in state and local taxes, and state royalties – underscoring its overwhelming economic impact.

Texas’ competitiveness in resources, business climate, and trade is intimately intertwined with the tremendous growth of industry, highlighted by records spanning production, processing, and exports for oil, natural gas, and NGLs. With the right enabling energy policies, the future promises continued prosperity for our state and nation, advancing domestic economic and energy security, while also making environmental progress at home and abroad, all while maintaining global energy leadership.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.