AUSTIN – The following is an analysis by Texas Oil & Natural Gas Association (TXOGA) Chief Economist Dean Foreman, Ph.D.:

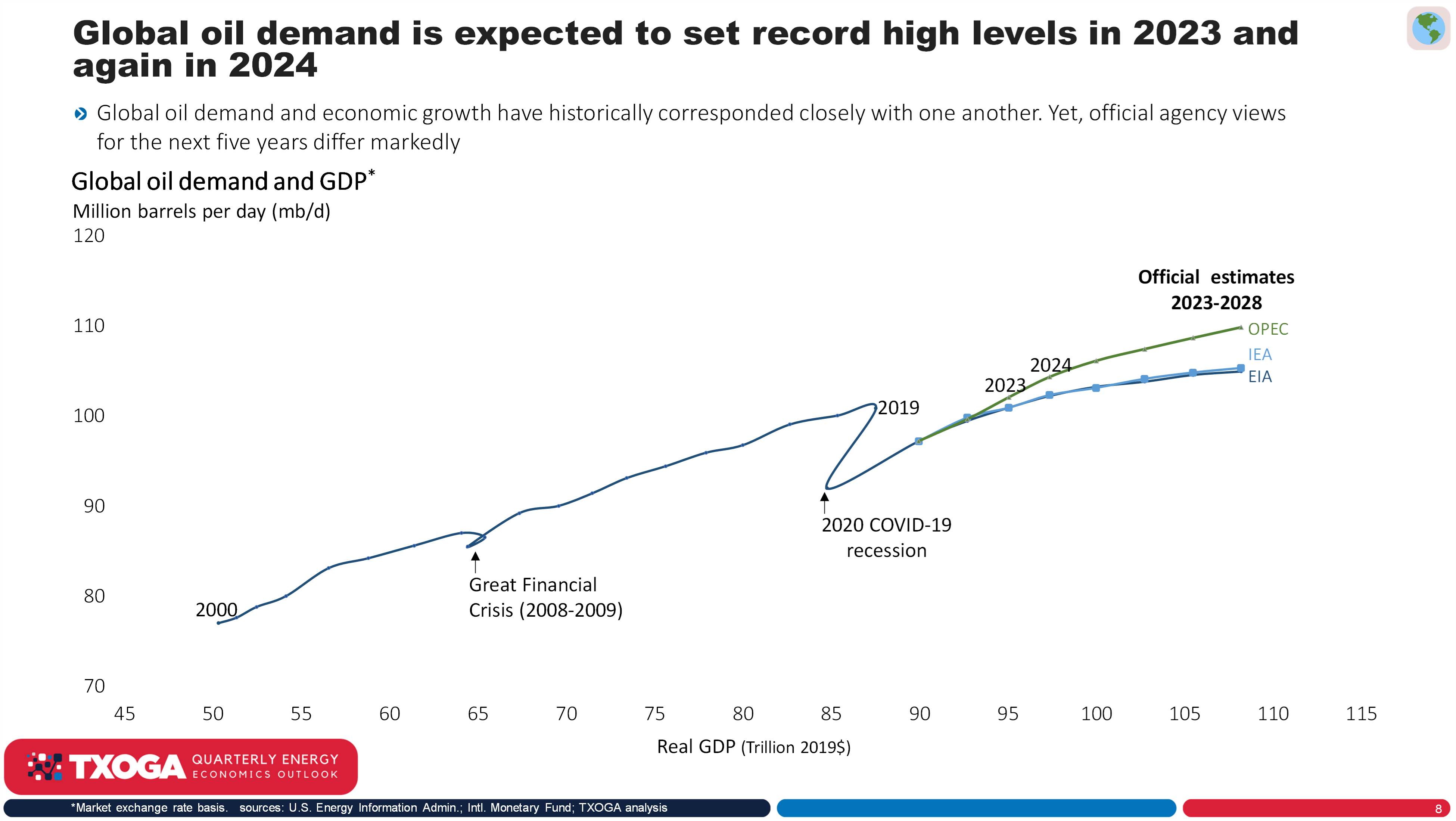

The U.S. Energy Information Administration (EIA) – the U.S. government’s official source for energy data and trends – has issued projections of global oil demand growth between now and 2028 that are half the projection of other major official sources. If our own government has underestimated the world’s need for oil and makes policy decisions that assume low demand growth and discourage investment in our own energy resources and domestic energy development, America could fall irreversibly behind, with American consumers paying more for energy and being overly reliant on OPEC+ nations, whose objective has been to increase their market power and prices.

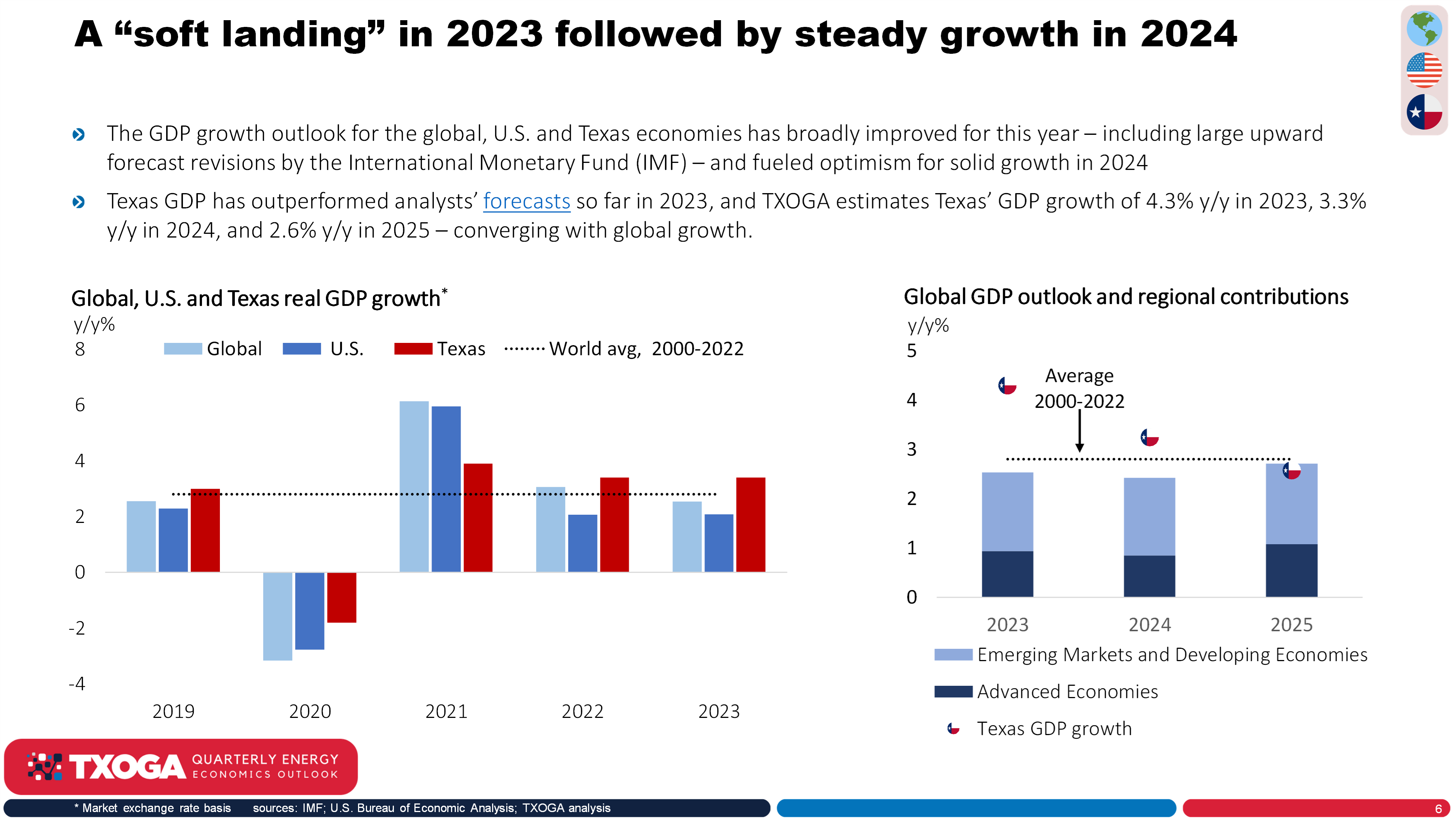

There is unanimous consensus that the global population will continue to grow, and that population growth drives economic and oil demand growth. Currently home to 8.0 billion people and expected to grow to 9.8 billion by 2050, our planet’s energy needs are set to rise. As such, both OPEC and the EIA project oil demand growth through 2045 and 2050, respectively. However, their near-term demand growth projections vary widely.

OPEC’s five-year projection implies a global oil demand growth twice that of our government’s projections – a difference of nearly 3.9 million barrels per day (mb/d), which is comparable to all of the oil supply non-OPEC producers added to the market over the past five years. The gap between OPEC and EIA’s projections could necessitate almost $200 billion in capital investments in the next few years.

Adding fuel to this debate, the International Energy Agency (IEA) anticipates a peak in oil growth demand by 2030 – 7 years from now. OPEC suggests that IEA’s projections could lead the global energy system to “fail spectacularly.” Should the EIA and IEA forecasts discourage oil production investment by non-OPEC countries, this could inadvertently strengthen OPEC’s market dominance. As global demand continues to grow, if American investments don’t keep pace, it could jeopardize our nation’s energy security and the stability of global energy markets.

However, amid these contrasting viewpoints, there is agreement: the U.S. is expected to be the world’s largest source of global oil supply growth. Specifically, the EIA projects the U.S.—with Texas at its forefront—to contribute up to 60% of non-OPEC supply growth between 2023 and 2028. However, for strong U.S. production growth to become a reality, this will require tens of billions of dollars in affirmative investment decisions to be made, supported by access to resources and expanded infrastructure through the value chain, from drilling and services to processing, pipelines, and export facilities. These are stark reminders of the long planning period and alignment across an entire supply chain the industry needs–and why the most recent five-year demand projections from EIA could chill investment in future U.S. oil output.

The oil and natural gas sector generally requires timely capital investments with long lead times to build new capacity. The current market, however, is marked by a combination of record global oil demand, U.S. demand as of October 13 that exceeded its 5-year range, U.S. ending stocks of crude oil at the bottom 5% of their 5-year range, and the lowest U.S. Strategic Petroleum Reserves since 1983.

Starting with their projections for 2024, all three agencies—EIA, IEA, and OPEC—anticipate record global economic activity and oil demand next year. Yet, the range of their estimates varies by over two million barrels per day (2% of the global market), primarily based on differing views about the pace of electrifying vehicles in advanced economies.

Such disparities underscore the need for U.S. energy policymakers to have pragmatic conversations about energy and enact sound policies. The energy sector is a marathon, not a sprint. Crafting policies that promote resource access, encourage investment and facilitate infrastructure development is crucial. It’s a reminder that the long-term vision is crafted from myriad short-term decisions.

As the world navigates challenging uncertainties, divergent oil forecasts serve as a strong reminder of the oil and natural gas industry’s complexities. While it’s common for predictions to vary, the current stakes, especially with recent geopolitical and economic developments, make this divergence especially consequential. Smart policy, rooted in sound data, will ensure that the U.S., particularly Texas, can serve as a stabilizing force for the world. Decisions made today will echo in the annals of energy history, underscoring the delicate balance between immediate choices and their long-term repercussions.

Let’s dig into the details, starting with the latest global economic outlook from the International Monetary Fund (IMF) and its oil market implications.

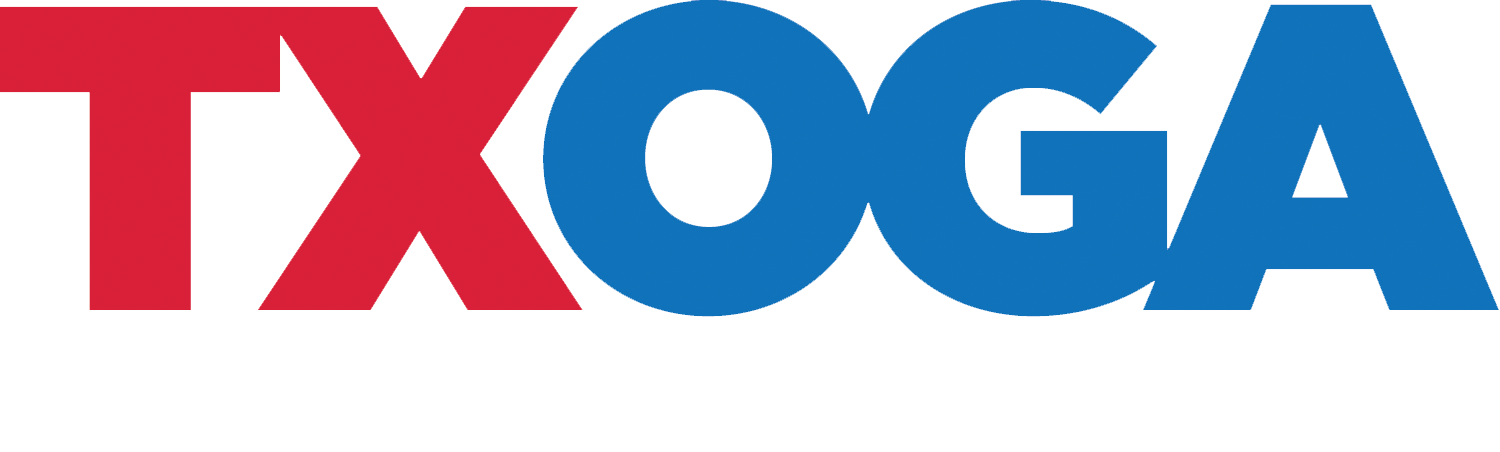

An understanding of oil demand generally begins with the economy. In one of the most significant upward revisions to GDP estimates in the last two decades, this month the IMF revised its GDP growth estimates for 2023 up by about one-third, based on actual (market) exchange rates. The GDP estimates now jibe with what historical relationships to oil demand growth generally tell us about the economy.

A simple rule of thumb is two-to-one. That is, for every percentage point that global GDP grows, the world generally needs another 0.5 mb/d of additional oil supply to sustain that activity level. In this case, global oil demand has been on pace for growth of 1.3 mb/d y/y compared with 2022 per EIA, which is consistent with global GDP growth of around 2.5% y/y – and that’s about what IMF’s outlook now says on a market exchange rate basis.

Importantly, the relationship between economic and oil demand growth has remained strong and consistent with the world’s underlying demographics. With 8.0 billion people currently on the planet, projected to grow to 9.8 billion people by 2050, per the United Nations, global energy needs are almost assured to grow. Intuitively, emerging markets are relatively more energy-intensive than developed economies and are also expected to account for most of the growth. With this backdrop, one would think that the global oil market outlook could be clear, but let’s consider next the stark differences between the official agency views.

For 2024, despite all three official forecasts agreeing on a new high for global economic activity and oil demand, there’s a variance in oil projections ranging from EIA’s 102.2 mb/d to IEA’s 103.1 mb/d and OPEC’s 104.3 mb/d. The primary distinction in these projections until 2028 revolves around the electrification rate of light-duty vehicles in advanced economies.

On the oil supply front, while there’s consensus that the U.S. will be the primary source of growth, the unity ends there. Projections about OPEC’s role differ widely, with some predictions indicating a decrease in OPEC supply and others suggesting a competitive drive for market share.

The potential risk lies in a scenario where the low demand growth perspective influences energy policies, while the actual global economy results in high demand growth. In such a situation, oil markets could become progressively constrained.

Oil market predictions seldom vary so much in short periods, which underscores the inherent complexities and uncertainties of global energy. As official agencies present differing outlooks, the ripple effects on investments, supply chains, and prices are hard to overlook. While divergent views are not uncommon in predictive analysis, the stakes, given the geopolitical and economic implications, are undeniably high.

Unanimity on the pivotal role of the U.S., particularly Texas, offers clarity amid an otherwise murky outlook. For policymakers, stakeholders, and consumers, navigating these predictions will require foresight, flexibility, and strategic decision making under uncertainty. For certain, ensuring U.S. energy security will be contingent on the decisions made today, reminding us of the intricate balance between immediate actions and long-term ramifications.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.